So, I was encouraged by the results of a survey, released last week, that showed wine merchants believe there is a good chance of consumers adopting alternative packaging, although they think bag-in-box containers and aluminium cans stand the best chance of success. Also encouraging are their plans to list wine in alternative packaging over the next two years and their view that the market could carry small mark-ups for such packaging.

Their views are published in a comprehensive report on the foreseeable adoption of alternative packaging formats. Published by ProWein, the results provide producers with valuable insights as to which packaging alternatives are demanded in which countries and where merchants show a particularly strong interest in listing alternatives to glass.

The results also show producers’ and merchants’ views on how existing challenges for the introduction of alternative packaging can be overcome.

Highlights of the report

It’s commonly understood that the energy consumed by manufacturing glass and transporting the bottled wine accounts for a lion’s share of wine’s carbon footprint, estimated by experts to be up to 40%. If wine production and trade is to become sustainable, the sector needs to put some thought into alternative packaging. By using suitable alternatives to glass, which have a low weight and that can ideally also be recycled, wine can be produced and transported more sustainably.

The newly published ProWein Business Report 2022 polled nearly 2,500 merchants and producers from 16 different countries on the adoption and planned launch of six different alternative packaging formats. The aim was to better understand the drivers of, and obstacles to, their further market penetration.

Wine merchants expect good adoption among consumers

With a view to gauging consumer sales potential, wine merchants, importers, distributors, restaurateurs and hoteliers were asked which alternative wine packaging would be easily accepted by consumers in their opinion. The idea was that polling market experts rather than consumers would give a more realistic assessment because consumer statements are often overly positive.

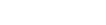

More than one in two merchants expect consumers to adopt bag-in-box as wine packaging since this has been an established format in many countries for many years. This is followed a long way behind by aluminium cans, paper-based bottles (such as the Frugal bottle below), PET bottles (eg Packamama) and kegs at just under 20% of expected adoption. In most countries these packaging formats are hardly available for wine and, hence, rather unknown to consumers.

Bag-in-box and aluminium cans are top for producers, too. This pattern is typical of product innovations: already known solutions find it easier to be adopted. PET bottles are known to some from airplanes and festivals while paper-based bottles are de facto not widely available on the market yet. The “others” mentioned by producers and merchants included light glass bottles and returnable systems with a deposit, which are suitable for regional sales schemes.

However, in numeric terms, the absolute willingness to adopt these options on the part of the trade and producers, in particular, is clearly lower than the adoption rates expected among consumers. 60% of producers and 45% of merchants have no plans for offering alternative packaging over the coming two years. This means there is an adoption gap – the market potential is not fully exploited yet.

Merchants from different countries vary widely in terms of their innovative drive

The 16 countries under review vary widely when it comes to their merchants’ willingness to list new packaging alternatives. In the group of ‘innovators’ including the Scandinavian countries, Great Britain and Canada, 75% to 100% of merchants are willing to do so.

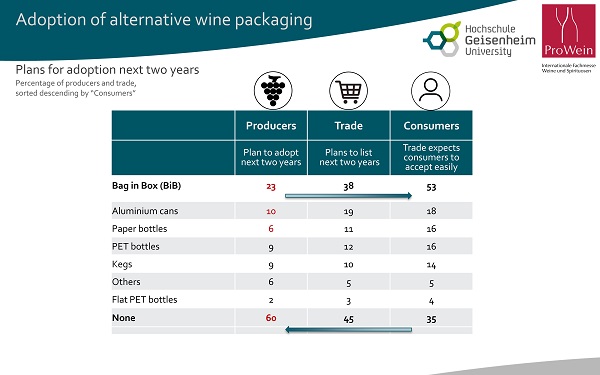

In the middle group, encompassing France, Belgium, Spain, Portugal and the USA, willingness stands between 55% and 75%. The third group of ‘laggards’ predominantly includes the German-speaking countries Germany, Austria and Switzerland but also the Netherlands and Italy. Here, merchants’ willingness is below 55%.

The five Scandinavian monopolies, including Iceland and the Faroe Islands, have committed to a joint sustainability strategy with the aim of reducing CO2 emissions by 50% by 2023. The targeted listing of wine in packaging with a small carbon footprint forms part of the strategy to achieve this ambitious target.

In the innovator countries, the overwhelming majority of merchants plans to list additional products in glass alternatives over the next two years – with bag-in-box leading the way, except in Canada, where the focus appears to be on aluminium cans.

84% of innovators know from their own experience that communicating with consumers about novelties and their benefits is the essential key to success. 57% see the need to further reduce the price disadvantages of alternative packaging to have consumers adopt them. To 81% of innovators, the rising energy prices for glass production are a crucial driver to reduce this cost gap.

PET bottles, like the one above, are also in the mix of options – which may come as a surprise since plastics are associated by many with single-use packaging and marine litter. Monopolies, however, use a deposit system today, allowing these PET bottles to be recycled almost completely.

For producers, these results mean that those capable of offering their products in alternative packaging stand a better chance of being listed in these innovative countries. Innovative wine producers who support merchants’ sustainability goals, therefore, clearly enjoy a competitive edge.

'Innovative wine producers who support merchants’ sustainability goals clearly enjoy a competitive edge'

PET bottles for Portugal and kegs for the USA

More than 50% of merchants in the medium group, which includes France, Spain, the USA, Belgium and Portugal, intend to list wine in alternative packaging over the next few years. Here, too, bag-in-box and cans rank first, followed by PET bottles (most prominent in Portugal) and kegs for food service (very prevalent in the USA). There is also demand for paper-based bottles in the middle group.

Cans for Italy and the Netherlands

In the countries lagging behind, the willingness to list alternative packaging is just under or slightly above 50%. Especially in the three German-speaking countries Germany, Austria and Switzerland, the majority of merchants have still stuck to glass bottles so far.

The list of alternative packaging is led by bag-in-box here, too, with the exception of Italy and the Netherlands where cans are in high demand.

Among merchants, the still very reserved demand for new packaging makes it harder also for mostly smaller producers from German-speaking countries to achieve high enough production and sales volumes for glass alternatives that make economic sense in their home markets.

The challenges during adoption

Merchants particularly face the challenge of communicating with consumers. However, they are very flexible and can offer packaging alternatives in line with demand. By comparison, producers are far more limited in their abilities to offer wine in alternative packaging.

Most existing bottling lines are strictly limited to one type of packaging, so far almost exclusively to glass bottles. For 69% of producers, it is therefore significantly easier to offer packaging alternatives that are compatible with existing filling lines.

In the current economic crisis, a major share of wine producers cannot pass on cost increases to retailers or consumers and therefore suffers dwindling or even negative margins. Due to this difficult climate, many producers are clearly coming up against limits to invest in new equipment.

The availability of alternative packaging posed a challenge to roughly half the producers. At the time of the survey in November 2022, inliner bags for bag-in-box were partly out of stock, for example. As global supply chains recover further, a relaxation can be expected here in future.

Almost two-thirds of producers consider increased glass prices as an opportunity for the faster market penetration of alternative packaging. Since producers are immediately affected by the price increases in glass and energy, their approval is noticeably higher than in the trade where only one in two merchants sees a correlation with energy costs.

Key take-aways for the industry

Three principal conclusions for the industry can be drawn from the results of this ProWein survey:

The sector should close the adoption gap better. Merchants believe there is a higher acceptance among consumers for many packaging alternatives than is currently being leveraged.

The innovators have learnt by experience that the crucial success driver is in-depth communication with consumers. To be able to communicate convincingly, however, merchants themselves first have to be convinced of the necessity of alternative packaging and its prospects for success.

Producers will invest in new filling lines if there is strong demand from the trade and if they receive long-term buying commitments. Producers’ low flexibility and the capital tied up in existing filling lines account for their reticence to offer alternative packaging. Innovative markets allow forward-looking producers to become established with their new products.

The study was commissioned by ProWein and carried out by the Department of Wine and Beverage Business at Geisenheim University under the direction of Prof. Dr. Simone Loose. Geisenheim University is known worldwide for its research and teaching in the field of wine science.

English

English French

French

.png)